· 22 days ago

IBRL

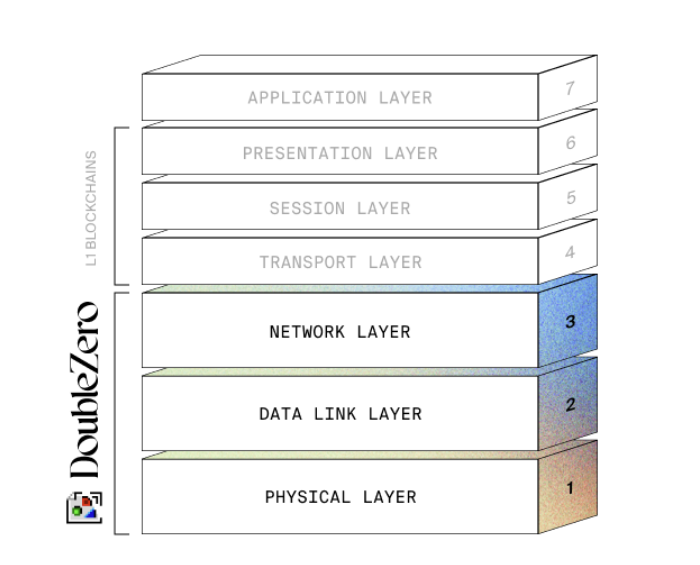

DoubleZero is an attempt to accelerate the flow of packets over the physical network layer around the world. How? By creating a permissionless marketplace for high performance network links—AKA dedicated fiber. DZ sits below L1s in the context of the OSI stack.

Today, DoubleZero (DZ) launched onto mainnet-beta. Multicoin Capital co-led a $28M investment round in DoubleZero earlier this year.

Blockchains are globally distributed systems. The core L1 teams have collectively invested $1B+ over the last decade optimizing networking protocols, consensus, execution, and storage. But there is one layer of the stack they haven’t yet tried to tackle: the physical network layer. Intuitively, this feels out of scope for L1 teams. And yet, in a globally distributed system, the physical network layer is obviously paramount for overall network performance.

DoubleZero is an attempt to accelerate the flow of packets over the physical network layer around the world. How? By creating a permissionless marketplace for high performance network links—AKA dedicated fiber. DZ sits below L1s in the context of the OSI stack.

What’s private fiber?

Broadly speaking, there are two kinds of internet lines around the world: public and dedicated. The vast majority of internet traffic flows over public lines connecting cities, states, and even continents.

Around the 2008-2010 period, trading firms started to realize that the public internet was too slow and unreliable for their latency requirements. And so they began investing in dedicated networking infrastructure to ensure reliable and low latency packet delivery.

Today, the largest trading firms in the world—Jump, Citadel, HRT, Two Sigma, DRW, etc.—all have billions of dollars of customized network equipment spanning many modalities from undersea fiber cables to custom microwave towers that beam radio waves across Lake Michigan. Many of the largest tech companies—Google, Facebook, Microsoft, Amazon, etc.—also have global dedicated fiber connecting their data centers around the world.

DoubleZero is a permissionless network that allows any owner of dedicated network infrastructure—from undersea cables to microwave towers—to contribute access to their un- or under-utilized infrastructure. Previously, only the largest and most sophisticated customers in the world (e.g., HFT firms, Google, Meta) could access dedicated fiber. DoubleZero makes this available to anyone.

With DoubleZero powering Solana mainnet-beta, validators will come to consensus faster, data will flow more freely and quickly, and users and market makers will land transactions faster. We believe it’s a win-win for everyone.

Yet DoubleZero is not just for Solana. We expect every major L1 will adopt it in the years to come, as we believe it will be impossible for others to compete with DoubleZero-enhanced networks. Moreover, the network can even serve centralized sequencer L2s by helping them fan out data to various localized RPC servers around the world for latency sensitive applications (e.g. trading).

Looking further to the future, we expect DoubleZero will be adopted beyond core blockchain infrastructure. Any latency-sensitive internet application can be a customer of DoubleZero, and in time we expect that video calling, real-time global augmented reality, and competitive gaming services will all use DoubleZero.

On September 29, 2025 DoubleZero’s prospects for large-scale adoption cleared a significant hurdle when the U.S. Securities and Exchange Commission’s (SEC) Division of Corporation Finance issued a no-action letter (NAL) to DoubleZero, granting relief with respect to certain planned programmatic transfers of the protocol’s native token, the 2Z token (2Z). Users pay fees in 2Z to transmit communications over the network, and a portion of these fees is programmatically rewarded to network providers as compensation for their provision of fiber links and operation of hardware comprising the network. Additionally, resource providers are programmatically compensated with newly minted 2Z for tracking user interactions and payments, calculating network provider fees and otherwise administering the protocol.

The NAL confirms that the Division of Corporation Finance will not recommend enforcement actions for such programmatic transfers of 2Z, thereby confirming that these transactions do not require registration as securities transactions under U.S. federal securities laws. By reducing legal uncertainty, the NAL offers DoubleZero a clear pathway to launch and operate its network today and reinforces the SEC’s continued recognition of responsible innovation in the digital asset space.

Austin Federa and DoubleZero Foundation’s general counsel Mari Tomunen worked with the SEC to achieve this outcome for the network. We’ve known Austin for years, and we were incredibly excited when he told us he was joining forces with Andrew McConnell and Mateo Ward, who have decades of experience building high performance dedicated fiber networks for Jump. We believe that the DoubleZero team is stacked with the best networking engineers, intimate knowledge of high performance blockchains, and an incredible go to market team.

Author Kyle Samani

Source https://multicoin.capital/2025/10/02/double-zero-ibrl/

Repost this post?

Share with your followers.

Reply